The Hudson’s Bay in downtown Vancouver already looks like it’s going out of business.

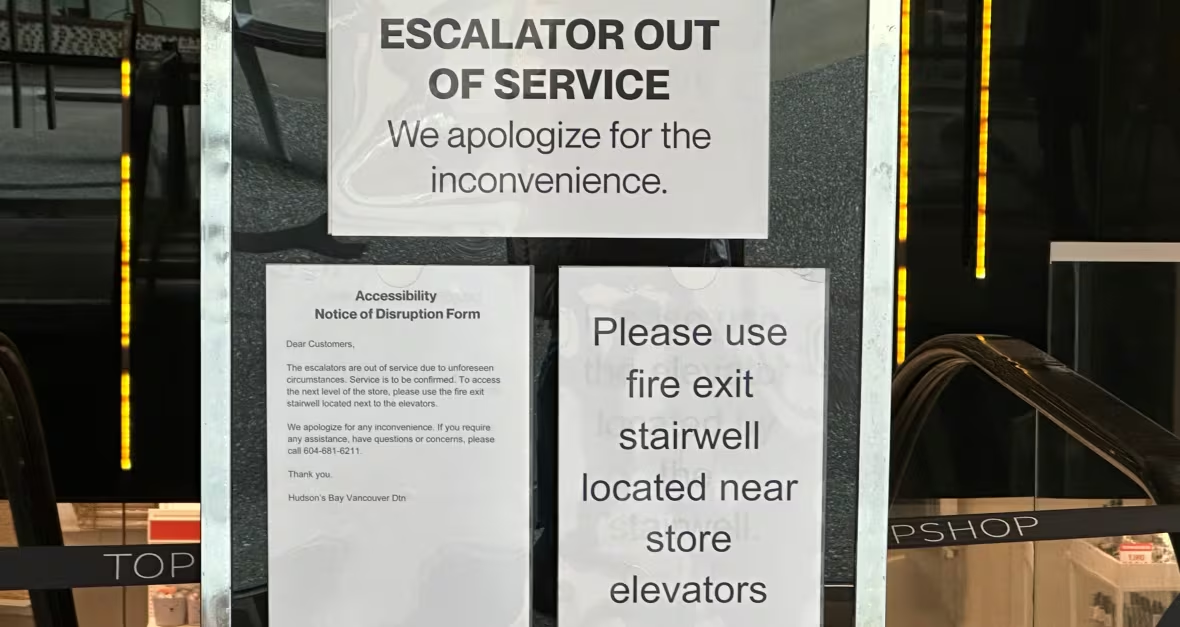

When entering the store, shoppers are greeted by warning signs that neither the store’s elevators nor escalator work, and they must use the fire exit stairs.

Employees aimlessly patrol fragrance and cosmetic booths with no customers in sight.

Hudson’s Bay was, for decades, a major shopping destination, offering multiple floors of fashion, accessories, furniture and appliances.

But now, it’s likely to meet the same fate as other big department stores in Canada like Eaton’s and Sears, which have already closed their doors due to slow sales and mountains of debt.

Hudson’s Bay is still holding out hope it will find a buyer for all or part of its business. But a more likely scenario is that the deeply indebted retailer will soon shut down, and start liquidation sales as early as this week.

Smaller versions of the department store model are still thriving, such as discount chain Walmart and Canadian fashion retailer, Simons. But the iconic department store with window displays and several floors of varied merchandise is coming to a close in Canada.

Some experts say the reason, at its core, is simple: These retail giants got stuck in tradition and didn’t change with the times.

“They were trying to work with an outdated model,” said retail strategist David Ian Gray. “It just, over time, became archaic.”

That sentiment is echoed by shoppers who feel bad for the Bay — and don’t shop there.

“It’s kind of sad that they’re going out of business,” said David Genio outside the Bay in downtown Vancouver.

But in the next breath, he added: “Their stuff is a little outdated I find and catered towards older people.”

Outside the Bay in downtown Toronto, Cathy McCabe-Lokos agrees that the chain’s demise is sad. But she also admits that the location “has been empty, kind of desolate for years.”

The encroaching specialty shop

Toronto’s Eaton Centre shopping mall is a microcosm for the demise of the traditional department store. It opened 1977 with Eaton’s as its anchor — one of Canada’s largest department store chains at the time. However, Eaton’s declared bankruptcy in 1999, after more than 100 years in business.

Department store giant Sears took over the space until 2017, when it met a similar fate and shut down. U.S.-based Nordstrom then took over until 2023, when it pulled out of Canada due to lagging sales.

Gray says, starting in the 1990s, two big shopping trends aided the demise of the traditional department store: the growth of e-commerce and specialty shops.

He says department stores allowed shoppers to browse a large selection of merchandise, and gave them access to coveted brands smaller stores didn’t carry.

But the emergence of online shopping allowed many brands to bypass department stores and sell directly to shoppers. It also meant Canadians could check out what’s for sale without leaving their house.

Hudson’s Bay Company says it will start liquidating its entire business and begin the process of closing all its stores, pending court approval. The announcement comes just days after the company applied for creditor protection.

“The idea of going to a department store and spending a couple hours just to keep current was completely irrelevant,” said Gray, founder of DIG360 Consulting in Vancouver.

“We stopped window shopping.”

The growth of specialty retailers — like Ikea for furniture and Best Buy for electronics — also hurt the omnibus department store.

They got “kicked at by specialty stores… that did it better and offered better range, and better value, and better servicing,” said retail analyst and author, Bruce Winder.

He cites as an example Sears, which used to be a go-to place for appliances.

“They were number one, right? And then Home Depot started eating their lunch,” he said of the U.S.-based home improvement retailer, which arrived in Canada in 1997.

As department stores across Canada struggle to stay afloat, Quebec’s Simons is expanding, with two locations opening in Toronto next year — bringing the total number of Simons stores in Canada to 19.

Winder says the versions of the department store that still thrive in Canada, such as Walmart and dollar stores, still appeal to shoppers because their varied goods are priced at a discount.

“The concept of having many different categories under one store is not forbidden. It’s not bad, but you have to have the right price point,” said Winder.

If you don’t, he said, shoppers will trek to specialty stores where they’ll typically pay more, but get added customer service.

“At the Bay, if I saw a design from Gucci, well, I can just go to the Gucci store and get it,” said Winder. “The expertise is better and the pricing is the same.”

Simons moves in

Sometime this year, Quebec-based retailer Simons is set to move into part of that ill-fated empty space in the Eaton Centre once inhabited by Eaton’s, then Sears, then Nordstrom.

Retail experts predict Simons may have better success because, by selling only clothing and housewares, it’s more of a specialty than a department store.

Also, many items Simons sells are private-labels shoppers can’t find elsewhere.

The retailer’s model is perhaps one traditional department store giants should have considered when they began losing shoppers. But, as Gray points out, it’s hard to reinvent the wheel when your model was successful for decades.

“It’s almost impossible to then say, ‘Hey, we’re smart enough to see the writing on the wall and we need to blow that up to be successful again.'”